The big shed market is at a turning point in 2025, according to experts, with investment increasing and a rise in demand after a quiet couple of years.

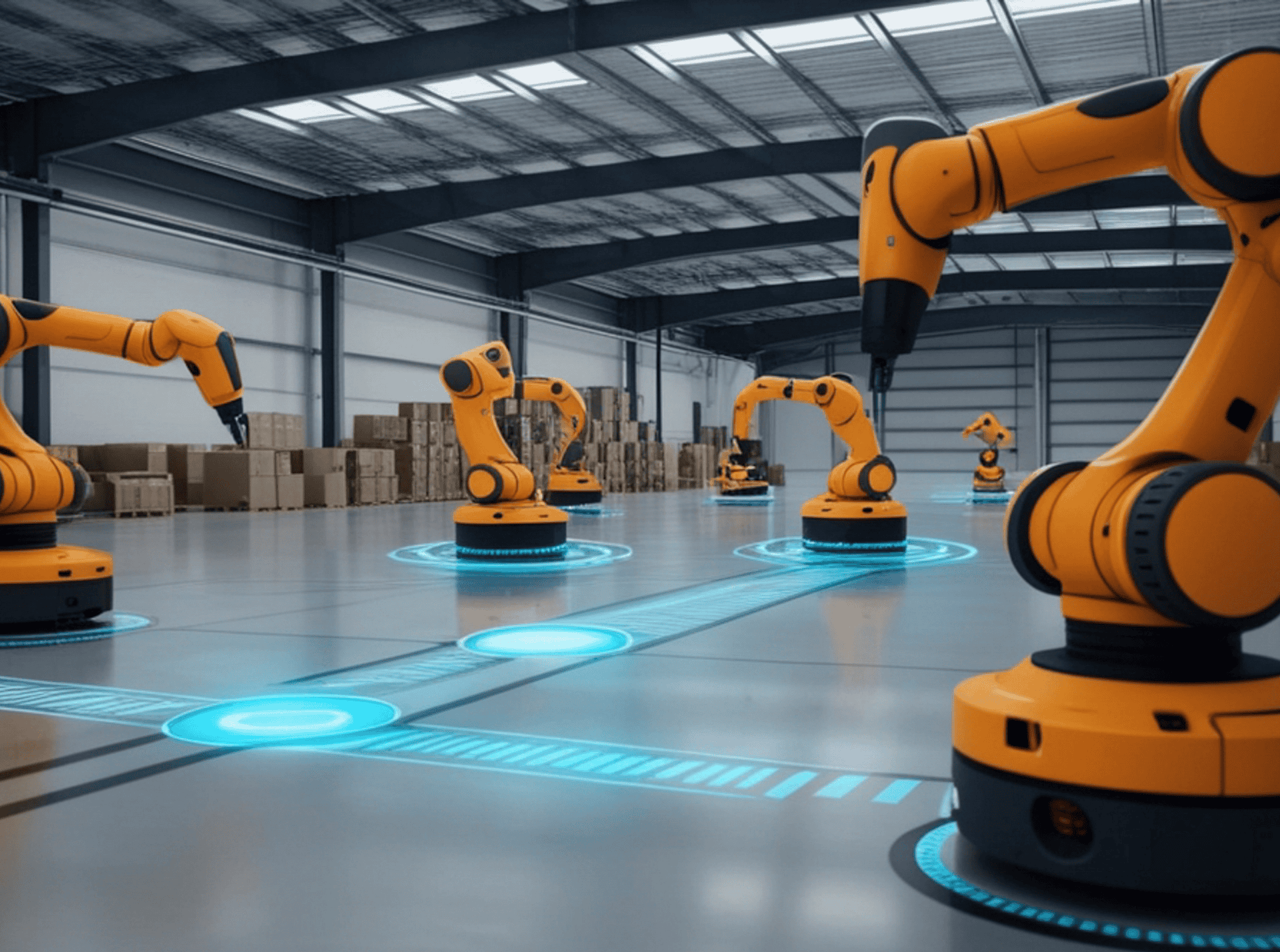

Hi-Level Mezzanines are specialists in mezzanines for super-warehouses, helping prestigious clients make optimum use of their space and meet the challenges of automation.

Logistics Manager has highlighted how a big shed could be “the lynchpin of a sprawling distribution network or even the sole premises to service the nation.”

After a slow 2023 and 2024, take-up improved at the end of last year with the market displaying “cautious optimism”, which has now been upgraded to “quiet confidence”, it reported.

Investment increasing

Enquiries are said to be soaring (up 30% in Q1 2025 compared to Q4 2024, according to Prologis UK) and transactions are completing.

Moreover, big-box investment activity increased by 9% year on year to reach £393 million in early 2025.

Amazon is taking space once again, and there is demand notably from data centre businesses, pharmaceuticals and the defence sector.

There is competition for industrial space, however:

- 3PLs accounted for c. 35% of deal volume in late 2024

- Retailers made up c. 40%

- Manufacturing was on the rise at c. 25%, driven by companies responding to geopolitical risks by manufacturing more at home than overseas.

Hi-Level Mezzanines has worked with clients who feature among the world’s Top 20 biggest warehouses, including Amazon, ASOS, Ikea, M&S and Tesco.

Factors behind rising demand for super-warehouses include:

- e-commerce continues to grow, forecast to reach 35% of all retail sales by 2027

- the government’s promise to build 1.5 million homes by 2030 is likewise expected to drive major warehouse demand

- and high-quality ESG-compliant space is the biggest driver.

Advantages of mezzanines for big sheds

- Make the very most use of your current space, by doubling, tripling or quadrupling capacity.

- Install our unique robot-ready flooring ready for automation. Superbly hard wearing, it has a high point load to bear the weight of robots, an anti-slip surface and is quick to install.

- Build supply-chain resilience by holding more stock on site to prevent unexpected shortages, missed deliveries, last-minute substitutes and quality failures.

- Future-proof your business to meet growing customer demand without the costs and inconvenience of moving to a new site.

Big deals

Recent deals in the super-warehouse sector include:

- Clarion partners acquiring a £50 million logistics facility in Warrington

- Nike securing a 1.3 million ft2 pre-let at Magna Park, Corby

- Amazon taking Panattoni’s 885,000 ft2 speculative mega shed in Bristol (3PL tenant GXO will devote the whole space to Amazon) – with 17m+ clear internal heights, it offers huge opportunities for mezzanines

- McLaren Construction Midlands and North has broken ground on a 1 million ft2 distribution centre for Home Bargains owner TJ Morris in Doncaster – it expects to support 300 stores by 2028 in a fully automated facility

- Tritax Big Box REIT has bought the 650,000 ft2 Sainsbury’s distribution centre in Haydock in the North West in a £75 million off-market deal

- The £130 million acquisition of the Tesco distribution centre in Thurrock is another key transaction

- Logistics Manager reported on capacity for a 1 million ft2 building at Axis Works, Bristol.

Mixed picture on supply

Looking ahead, there is a mixed picture on supply.

- The UK currently has around 30 million ft2 of new unoccupied big boxes, according to CoStar group, and

- There is approximately 13 million ft2 of big box space under construction.

Core markets are performing well, such as the Golden Triangle of logistics, located in the area between the M1, M6 and M42 motorways, from Birmingham in the west to Nottingham and Derby in the north. It lies within easy reach of major ports, railways and airports, with the ability to deliver to 90% of the UK population within four hours.

However this concentrated development of core locations has contributed to oversupply, and the Golden Triangle has a high number of vacant units.

On the other hand, undersupply may soon be a more serious problem across a wider area because of investor caution over the past two years that saw speculative development of some units put on hold.

In East London, for example, rents have rocketed and there is said to be no guarantee that suitable spec-built sites will be available in the right areas. While some occupiers are looking outside the M25 in search of affordability, another cost-effective option is to install a mezzanine.

And if big sheds are not the answer for your business just yet, perhaps a mezzanine in a mid-box warehouse is what you need. Either way, Hi-Level Mezzanines has you covered.

Contact us today to talk about a mezzanine for your business.